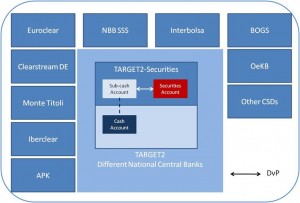

TARGET2-Securities (T2S)

T2S will be a single settlement platform offering Delivery versus Payment (DvP) settlement in central bank money, which is called CPSS Model I DvP, for different currencies on a real-time gross basis. Links between CSDs of the European Union will be redundant with the introduction of T2S, because the settlement can be processed on a single common platform. All CSDs, who will sign or already have signed the framework agreement (e.g. Clearstream) with the Eurosystem, will be directly connected with T2S.

Figure 14: T2S

(cf. Clearstream, 2009)

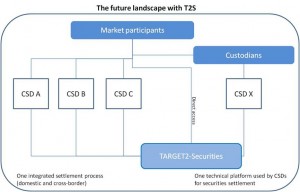

In addition agent banks will be able to route their settlement instructions directly to T2S and query related information through an web-based Graphical User Interface (GUI).

Figure 15: The future landscape with T2S

(ECB, 2010)

On 3 January 2012 two T2S connectivity licences were awarded to SWIFT and a consortium composed of SIA and Colt.

On 8 May 2012 9 CSDs signed the framework agreement in Frankfurt:

- Monte Titoli (Italy)

- BOGS (Greece)

- Clearstream Banking AG (Germany)

- LUX CSD S.A. (Luxembourg)

- NBB-SSS (Belgium)

- Depozitarui Central (Romania)

- VP LUX S.a.r.l (Luxembourg)

- VP Securities A/S (Denmark)

(see, ECB, 2012)